Generating mortgage leads can be challenging as most third-party lists have the same borrowers listed time and again. Besides having a healthy credit score, there are several other criteria to look at when looking for mortgage leads, and it’s usually the leaders with the most publicity who end up getting the most information.

In the grand scheme of things, however, getting quality mortgage leads depends on the ingenuity of your methods and how you constantly revamp your process. So, if you’re wondering how to get valuable customers in your mortgage lead funnel, you’ve come to the right place. In this article, we’ll cover everything you need to know to generate mortgage leads.

What Are Mortgage Leads?

The process of creating a funnel for developing potential prospects for lenders and financial institutions that are looking to sell qualified mortgages is known as developing mortgage leads. For lenders and financial institutions, finding prospects that quality can be a challenging task, due to the level of misinformation and fraud present in the industry.

Besides this, duplicate entries of the same prospect or a prospect that already has a mortgage is also an issue for some organizations.

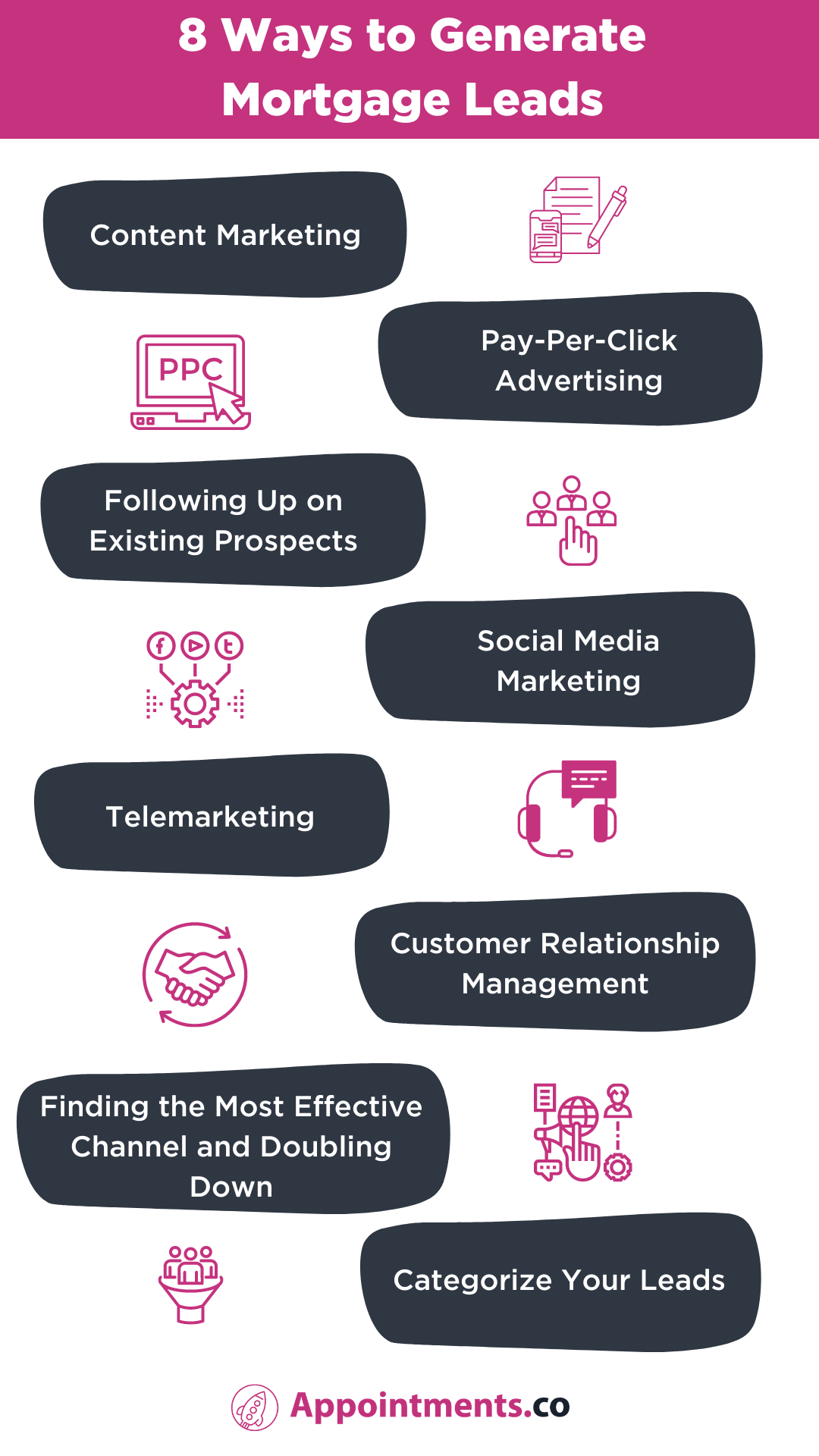

8 Ways to Generate Mortgage Leads

That said, tips or ways that you can create mortgage leads for your financial business depend completely on your business’s goals. In marketing, with the several avenues available making use of the most suitable marketing mix for your business depends on both your budget and planned timeline. In this article, we cover some of the various methods you can generate mortgage leads for your financial business.

1. Content Marketing

Probably the most affordable form of marketing that is very effective in the long run. Content marketing is an excellent way to grow brand awareness and get potential consumers interested. A popular way to develop new prospects is through free content available on the internet.

While it may seem time-consuming, creating video content on platforms like YouTube is a great option when it comes to educating people on financial information and mortgages. According to Hubspot, 86% of video marketers say video has been compelling for consistently generating leads.

While there are several different types of content channels and mediums to explore, on the whole, content marketing is the gift that keeps on giving.

2. Pay-Per-Click Advertising

Pay-per-click advertising is one of the most effective forms of marketing to work with. When it comes to having quick results, this form of digital marketing can be pretty effective.

Pay-per-click (PPC) advertising enables businesses to advertise their products and pay on the bases of clicks generated. Typically, these advertisements are displayed on the results page of search engines, based on the keyword(s) searched. Besides this, display ads and ad reels on YouTube videos are other forms of advertising.

When it comes to pay-per-click advertising, generating mortgage leads requires you to implement more unique methods due to how competitive the finance industry is.

Generally speaking, banking and mortgage-related keywords tend to be highly competitive so bidding on more niche keywords that have high traffic is the most effective route to take. For example, while the word “mortgage” may be expensive, targeting keywords like “mortgage refinancing” may be more affordable.

3. Following Up on Existing Prospects

In banking and financial services, trust and brand loyalty play a crucial role. While converting new prospects may lead to high client acquisition costs, upselling or cross-selling existing clients and prospects on some of the additional services you provide can be a feasible route to take.

In the case of mortgages and financial services, large clients tend to always be on the lookout for loan refinancing and additional credit streams. Following up on clients’ experiences and new opportunities to save on interest rates or capitalize on investments is a wise move.

Besides this, following up with prospective clients that showed interest through the form of inquiries, or online activity can consistently help expand your customer base. Besides this, sending enticing offers through direct mail and text messages can also be beneficial.

4. Social Media Marketing

When it comes to the most affordable form of marketing, social media marketing is at the top of the list. Social media platforms allow businesses to engage with their clients through social media posts that bring awareness about various financial avenues available.

While starting from scratch may seem challenging, working with financial YouTubers and Influences to help gain traction through sponsored posts can help to drive engagement. That said, using social media platforms that are viable for eligible demographics, like Facebook, YouTube, and LinkedIn can be strategically beneficial.

Social media marketing allows users the opportunity for both organic and paid engagement. Through the use of advertising campaigns, you can target prospects on the basis of age, geo-location, and even the type of phone they own.

5. Telemarketing

Telemarketing can be defined as direct marketing of products or services to potential clients or customers through the phone or the internet.

Although quite dated, nothing can beat the human interaction aspect of this marketing campaign strategy. Direct marketing, although most effective, is time and cost-consuming. Telemarketing, on the other hand, presents a transparent route to gauge a prospect’s interest level, create awareness, and in turn demand for loans and mortgages.

While unsecured loans can seem intimidating to the general public. Mortgages when paired with the appreciation rates of real estate outperforming inflation and interest rates, can seem a lot more enticing than unsecured loans. Generating mortgage leads through telemarketing does come down to the quality of your prospect list and how compelling your telemarketers are.

6. Customer Relationship Management

Customer acquisition can cost 25 times more than customer retention. When it comes to real estate investors and middle-income individuals, investing and building wealth is always a priority. Customer relationship management, unlike traditional lead generation, aims to maximize your customer’s lifetime value.

Customer lifetime value refers to the revenue to be generated by a particular customer over the course of their life. While it may seem ineffective, maintaining a healthy customer relationship through solving problems and providing users with customer service has proven to be an effective allocation of a business’s resources.

In doing this, calculating your customer retention rate and implementing initiatives to improve your current retention rate is a great place to start. In the process of retaining customers, your company also helps build brand trust and in turn a reliable brand image.

7. Finding the Most Effective Channel and Doubling Down

While each marketing avenue presents its own benefits and unique features, measuring their effectiveness is pivotal. When businesses look for effective results, measuring the conversion rate from various marketing channels to find the most effective for your business can save you both time and money.

When figuring out the best way to generate mortgage leads, given the competitiveness of the industry, doubling down on unique niches and channels can help significantly. Besides this, tailoring your content, pay-per-click ads, and telemarketing approach based on what’s proven to be most effective improves your revenue and expands your business. Given the several different avenues, it’s important that you try out each route and understand your target audience as best you can. In order to do this, creating multiple customer profiles based on the data collected and digital insights can be a game-changer.

8. Categorize Your Leads

More mortgage leads are coming in from different sources, and most of the time, they are not relevant to what you are looking for. By categorizing your mortgage leads, you can save the time and money you would otherwise lose in generating the wrong leads.

- MQL – MQL stands for marketing qualified leads. Leads sign up through your website and are ready to receive more information. However, they are still not ready to make a purchase. Therefore, you should ensure that the information you provide is relevant, engaging, and solves their questions.

- SQL – SQL stands for sales-qualified leads. Here, the leads are generated by research, and they are almost in the purchasing stage. Please make sure you are in contact with them to guide them to purchase.

Using the above two methods, you can easily categorize your leads, and based on that, you can plan your strategy and execute it.

Frequently Asked Questions

1. How much do mortgage leads cost?

For a single mortgage lead, you have to spend between $20 to $100. But if the lead is fake, you won’t get your expected end result.

2. What are the tips to generate mortgage leads?

Build your website with blogs, newsletters, images, and videos to provide people with the requisite information. You must ensure that the plan through which you are trying to generate mortgage leads is well organized. Audiences will be less likely to trust your information if it is disorganized or the website is not optimized.

3. What is the most cost-effective route to generate mortgage leads?

When it comes to the most affordable route to generate mortgage leads, social media marketing, customer relationship management, and following up on existing prospects are the most cost-effective.

4. Why is it difficult to generate mortgage leads?

The finance industry is both well funded and highly competitive, as a result, ranking for relevant keywords around mortgages, loans, or other financial services can prove to be challenging. That said, making sure your target specific niches, as well as your client’s interests yield the best results.

Conclusion

While developing mortgage leads can be strenuous proven how saturated the market is, implementing the right tactics to generate mortgage leads takes patience and strategy. When it comes to standing out on Google organically, creating helpful and insightful content can help you rank and generate leads in the long run.

However, when it comes to generating leads quickly and with more visible results, using routes like pay-per-click advertising, social media marketing, and telemarketing are effective. However, as mentioned above, customer retention and following up on existing leads can lower your acquisition costs significantly.

Generating mortgage leads is a challenging and arduous process, but keeping some of the points mentioned above in mind can help you go in the right direction.

Related Posts:

Illustrations by Storyset